Automotive fintech platforms are reshaping the way we buy, finance, and maintain vehicles. These innovative platforms are streamlining processes, enhancing customer experiences, and introducing exciting new possibilities across the entire automotive lifecycle. From streamlined financing options to integrated insurance and maintenance solutions, these platforms are poised to disrupt the traditional automotive industry.

The platforms leverage technology to offer a more efficient and transparent experience for consumers, dealerships, and manufacturers. This includes everything from digital financing applications to secure online marketplaces for vehicle transactions. They also facilitate vehicle maintenance financing and offer specialized insurance products tailored to automotive needs.

Introduction to Automotive Fintech Platforms

Automotive fintech platforms are digital solutions reshaping the automotive industry by leveraging technology to streamline and enhance various aspects of the vehicle lifecycle. These platforms use innovative financial tools and digital services to improve the customer experience and efficiency for consumers and businesses alike.These platforms offer a wide array of services, from financing and insurance to maintenance and resale, creating a holistic digital ecosystem for automotive transactions.

This allows users to access a diverse range of automotive-related services through a single, convenient platform.

Key Functionalities of Automotive Fintech Platforms

These platforms provide a variety of services beyond traditional automotive interactions. They facilitate seamless transactions and offer enhanced user experience, fostering trust and convenience in the automotive industry. These functionalities often include online financing applications, digital insurance management, and tools for scheduling maintenance.

- Online Financing: Platforms allow for easy and quick application processing for vehicle loans, reducing paperwork and potentially improving approval times. This often includes tools for calculating loan terms and comparing interest rates from different lenders.

- Digital Insurance Management: Users can manage their insurance policies, make payments, and file claims digitally, reducing administrative burden and providing greater transparency. This often includes features to monitor policy coverage and track claim status.

- Maintenance Scheduling and Tracking: Platforms allow users to schedule maintenance appointments, track service history, and manage repair costs. This enhances the user experience by making service records easily accessible and helping users plan and budget for maintenance.

- Vehicle Valuation and Resale Services: Platforms may offer tools for valuing vehicles and providing estimates for resale. This can be particularly helpful for owners considering selling their vehicle.

Types of Automotive Fintech Platforms

Automotive fintech platforms cater to diverse needs across the automotive value chain. They provide a wide range of services from financing and insurance to maintenance and resale, offering a comprehensive digital experience.

- Financing Platforms: These platforms specialize in providing digital financing solutions for vehicle purchases. They may offer loans, leases, or other financing options to consumers. Examples include platforms that connect borrowers with lenders, facilitating faster and more efficient financing processes.

- Insurance Platforms: These platforms focus on digital insurance services, including policy management, claim processing, and risk assessment. They can often offer customized insurance packages and pricing based on individual vehicle and driver profiles.

- Maintenance Platforms: These platforms connect users with maintenance providers, allowing for scheduling appointments, tracking service history, and managing repair costs. These often include options for comparing pricing from different mechanics and providers.

- Resale Platforms: These platforms focus on facilitating the sale and purchase of used vehicles. They often provide tools for valuing vehicles, connecting buyers and sellers, and managing transactions. These may include features to verify vehicle history and provide information about past maintenance.

Comparison of Automotive Fintech Platforms

The following table provides a concise overview of the different types of automotive fintech platforms, highlighting their key functionalities and target users.

| Platform Type | Key Functionalities | Target Users | Examples |

|---|---|---|---|

| Financing | Vehicle loans, leases, and other financing options. | Car buyers and dealerships. | LoanDepot, LendingClub |

| Insurance | Policy management, claim processing, risk assessment. | Car owners, insurers. | Insure.com, Progressive |

| Maintenance | Scheduling appointments, tracking service history, managing repair costs. | Car owners, mechanics. | RepairPal, CarMD |

| Resale | Valuing vehicles, connecting buyers and sellers, managing transactions. | Car owners, dealerships, buyers. | Carvana, Autotrader |

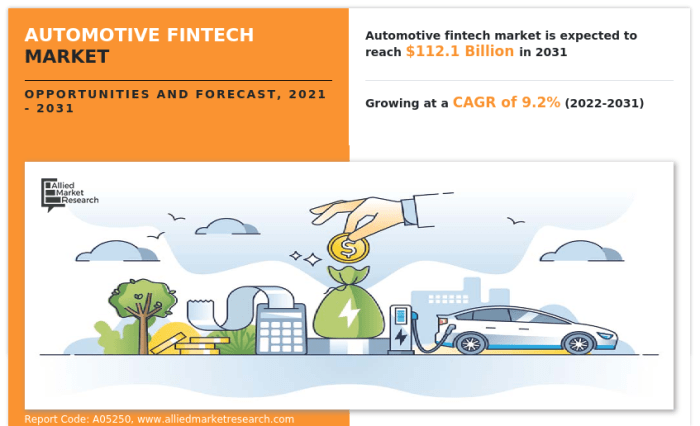

Market Trends and Opportunities

The automotive fintech landscape is experiencing rapid evolution, driven by shifting consumer preferences and technological advancements. This dynamic environment presents both significant challenges and exciting opportunities for innovation. Fintech companies are leveraging digital tools to streamline processes, enhance customer experiences, and create new revenue streams within the automotive sector.The key market trends shaping this space include a rise in digital transactions, increasing demand for personalized financial solutions, and the integration of innovative technologies like artificial intelligence and blockchain.

These trends are pushing the boundaries of traditional automotive finance, creating avenues for improved efficiency, transparency, and accessibility. Companies that can adapt to these trends and effectively utilize emerging technologies will be well-positioned for success in the future.

Major Market Trends

The automotive industry is undergoing a significant digital transformation, influencing the adoption of fintech platforms. Consumers increasingly prefer digital interactions and expect seamless online experiences, leading to a surge in demand for online car financing and insurance applications. Furthermore, the rise of shared mobility services is creating a new demand for flexible and innovative financing models.

Emerging Opportunities

The evolving landscape offers several exciting opportunities for automotive fintech platforms. One key area is the development of innovative financing solutions for new vehicle purchases and used car transactions. Another opportunity lies in the creation of personalized financial products tailored to specific customer needs and preferences, such as dynamic interest rates adjusted based on creditworthiness or risk profiles.

Moreover, fintech platforms can play a crucial role in improving the transparency and efficiency of vehicle maintenance and repair processes.

Disruptive Innovations

Several technologies hold the potential to disrupt the automotive fintech market. Artificial intelligence (AI) can be utilized to assess creditworthiness more accurately and efficiently, leading to faster loan approvals and more personalized financing options. Blockchain technology has the potential to enhance the security and transparency of transactions, reducing fraud and improving trust. These technologies, when integrated effectively, can significantly improve the customer experience and streamline operations for automotive dealerships and financial institutions.

Factors Driving Adoption

Several factors contribute to the increasing adoption of automotive fintech platforms. Improved user experience, offering convenience and speed, is a major driver. Reduced costs, through automation and streamlined processes, also play a significant role. Enhanced security, due to advanced encryption and fraud detection systems, further boosts confidence in digital transactions. Finally, the growing availability of mobile and online banking options is encouraging more consumers to engage with these platforms.

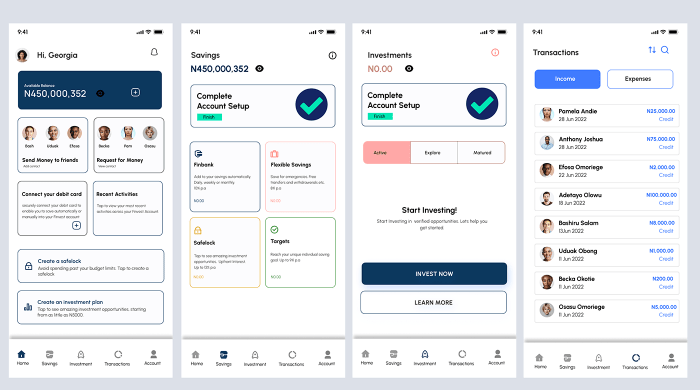

Customer Experience and User Interface

A seamless and intuitive user experience is paramount for automotive fintech platforms. A well-designed interface not only enhances user satisfaction but also drives adoption and fosters trust in the platform’s capabilities. Users should feel confident and empowered when interacting with the platform, knowing that their transactions are secure and their data is protected. The platform should be intuitive enough for novice users, while offering sufficient functionality for experienced users.The interface should not only be visually appealing but also highly functional.

Clear navigation, concise information displays, and easy-to-understand prompts contribute significantly to a positive user experience. A user-friendly design empowers users to accomplish their financial tasks quickly and effectively, reducing frustration and maximizing engagement. This ultimately translates to increased customer loyalty and platform growth.

Crucial Aspects of a User-Friendly Interface

A well-designed interface is crucial for user adoption and trust. Key aspects include intuitive navigation, clear information presentation, and readily accessible features. Visual appeal and consistency are equally important. This translates to a positive user experience and fosters a sense of confidence and control.

- Intuitive Navigation: Users should easily find the information and services they need without confusion or frustration. Clear labeling of buttons, menus, and sections, along with logical organization, significantly contribute to this. An example would be a well-structured dashboard that provides at-a-glance summaries of account balances, loan progress, and upcoming payments.

- Clear Information Presentation: Complex financial data should be presented in a clear and easily understandable format. Visual aids like charts and graphs can effectively illustrate key information, making it more accessible to users. This includes clear explanations of fees, terms, and conditions.

- Accessibility and Customization: The platform should be accessible to users with varying technical skills and needs. Customization options allow users to personalize their experience and tailor the interface to their specific preferences.

Seamless Integration with Existing Automotive Services

Integrating with existing automotive services is essential for a seamless user experience. Users should be able to easily link their existing accounts and seamlessly transfer funds or access relevant information without needing to re-enter data or switch between multiple platforms.

- Direct Account Linking: The platform should allow users to directly link their existing bank accounts, credit cards, and other financial accounts for streamlined transactions. This eliminates the need for manual data entry, reducing errors and improving efficiency.

- Data Synchronization: Real-time data synchronization between the fintech platform and existing automotive services ensures users always have access to the most up-to-date information regarding their vehicles, loans, and other relevant data. For example, a seamless integration with a vehicle’s service history platform can streamline the process of tracking maintenance.

Secure and Transparent Transactions

Security and transparency are paramount in automotive fintech platforms. Users must feel confident that their financial information is protected and that transactions are handled responsibly.

- Robust Security Measures: Implementing strong security measures, such as encryption and multi-factor authentication, is critical to protect user data and prevent fraudulent activities. These safeguards should be prominently displayed and clearly communicated to the users.

- Clear Transaction Details: Transactions should be clearly detailed, including fees, charges, and transaction histories. Transparency in fees and charges fosters trust and ensures that users understand the costs associated with using the platform.

User Experience Considerations for Various Platforms

| Platform Type | Key User Experience Considerations |

|---|---|

| Vehicle Financing Platforms | Ease of loan application, clear interest rates, and payment schedule visibility. |

| Insurance Platforms | Quick and easy claim submission, transparent policy details, and seamless payment processing. |

| Maintenance and Repair Platforms | Transparent pricing for services, scheduling options, and secure payment methods. |

| Used Car Sales Platforms | Easy vehicle search, secure transaction processes, and verification of vehicle history. |

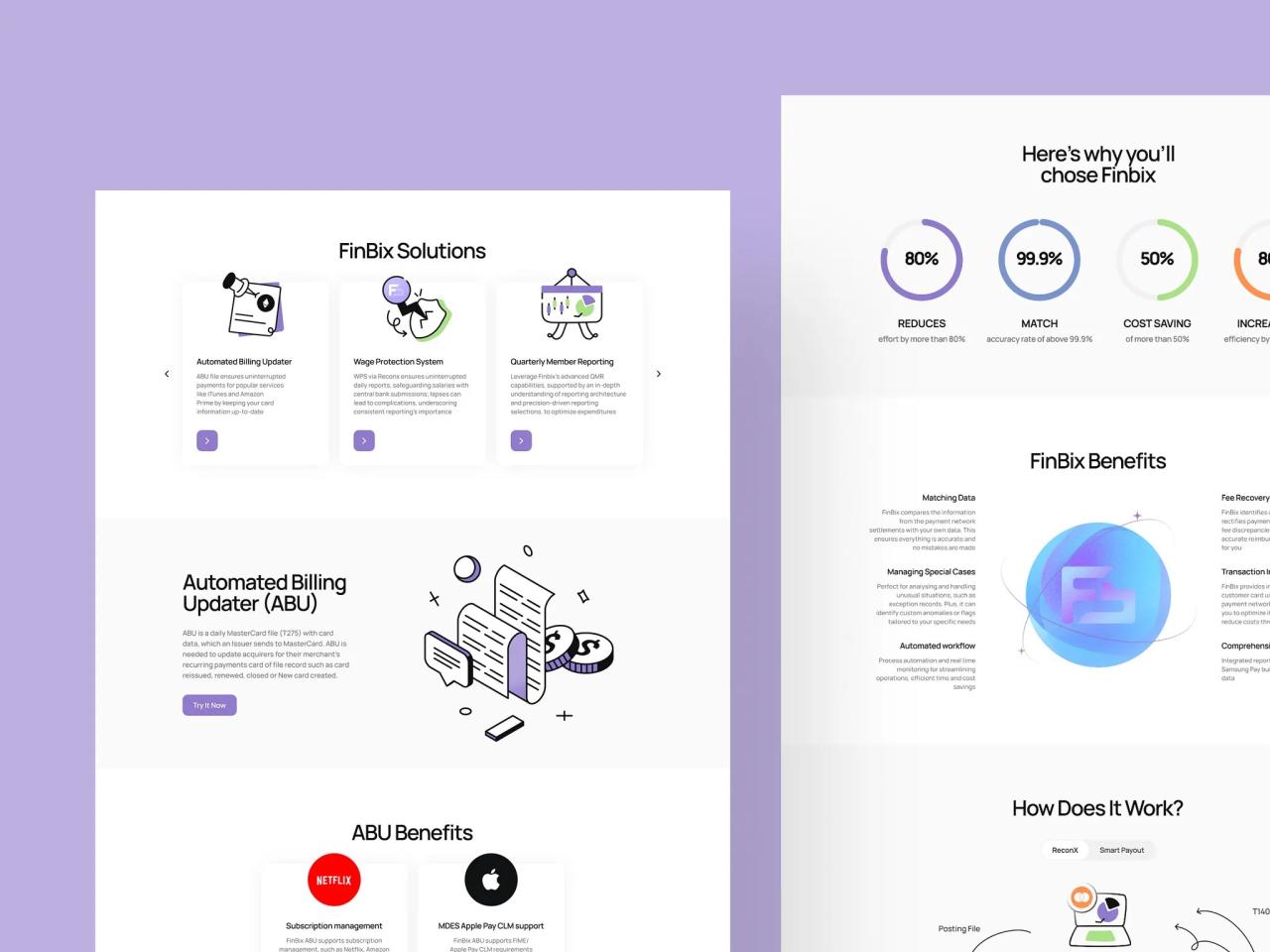

Financial Services Offered

Automotive fintech platforms are revolutionizing the way individuals and businesses interact with financial services related to vehicles. They offer a wide array of options, from streamlined financing to innovative insurance packages, all designed to improve the customer experience and make vehicle ownership more accessible and efficient.These platforms act as intermediaries, connecting consumers with various financial institutions and providers. They facilitate the entire process, from initial financing to ongoing maintenance, reducing administrative burdens and enhancing transparency for all parties involved.

Financing Options for Vehicle Purchases

A key component of these platforms is the provision of diverse financing options for vehicle purchases. This empowers customers with greater choices and tailored solutions.

- Traditional Loans: Many platforms partner with traditional lenders to offer competitive interest rates and loan terms. This often includes streamlined application processes, allowing customers to get pre-approved for loans quickly and efficiently. These platforms typically connect the customer with a range of lenders, ensuring a broader range of options.

- Lease Programs: These platforms also facilitate lease agreements, allowing customers to use a vehicle without the long-term commitment of a loan. This is particularly appealing to individuals seeking lower upfront costs or who frequently change vehicles.

- Subscription Models: A growing trend is the emergence of subscription-based vehicle access. This model allows users to access a vehicle for a monthly fee, potentially including maintenance and insurance. These platforms often offer various subscription tiers to cater to different needs and budgets.

Insurance Products Tailored for the Automotive Sector

Platforms are increasingly offering customized insurance products designed for the automotive sector. These products often go beyond standard coverage and address specific needs.

- Comprehensive Coverage: Insurance options may include comprehensive coverage, addressing damage from accidents, natural disasters, or other unforeseen events. The platform might provide additional coverage for specific situations, such as theft or vandalism.

- Maintenance Insurance: Platforms might offer insurance specifically designed to cover maintenance costs for vehicles. This can provide peace of mind, reducing the financial burden of unexpected repair bills. These policies can cover scheduled maintenance, unexpected repairs, and other associated costs.

- Vehicle Protection Plans: Some platforms provide vehicle protection plans covering parts or components. These plans may cover a specific part of the vehicle for a certain period, or offer a full protection plan for the whole vehicle.

Vehicle Maintenance Financing

Platforms are also playing a vital role in facilitating vehicle maintenance financing. This aspect helps users to manage their vehicle upkeep more effectively.

- Payment Plans for Repairs: Platforms often offer flexible payment plans for vehicle repairs, allowing customers to budget for necessary maintenance. This addresses the issue of large, unexpected repair costs.

- Maintenance Bundling: Platforms may bundle maintenance services with vehicle financing, offering a holistic approach to vehicle ownership. This can include regular servicing and preventative maintenance packages.

Technological Infrastructure and Security

Automotive fintech platforms require robust technological infrastructure to handle the volume and sensitivity of financial transactions, customer data, and vehicle information. This infrastructure needs to be scalable and resilient to ensure smooth operation, even during peak periods or unexpected events. Furthermore, paramount importance is placed on security protocols to safeguard sensitive data and prevent fraudulent activities.The technological infrastructure for automotive fintech platforms necessitates a secure and reliable foundation.

This encompasses a variety of components, including robust payment processing systems, secure data storage solutions, and reliable communication channels. These systems must be capable of handling a high volume of transactions and data, while simultaneously maintaining stringent security measures to protect user information and financial assets.

Data Security and Privacy Considerations

Data security and privacy are paramount in automotive fintech. Protecting sensitive information, such as financial details, vehicle identification numbers (VINs), and personal data, is crucial. Strict adherence to industry regulations and best practices, such as GDPR and CCPA, is essential to maintain user trust and avoid potential legal repercussions. Implementing encryption protocols, multi-factor authentication, and access controls are vital components of a robust security strategy.

Blockchain Technology’s Role in Transparency and Security

Blockchain technology offers a promising avenue for enhancing transparency and security within automotive fintech platforms. Its decentralized and immutable nature can create a secure and auditable record of transactions, reducing the risk of fraud and manipulation. Smart contracts, self-executing agreements, can automate processes, further streamlining operations and reducing human error. For example, a blockchain-based system can provide a secure and verifiable record of vehicle ownership, enhancing transparency in the used vehicle market.

Security Measures Implemented by Various Platforms

Different automotive fintech platforms implement varying security measures, reflecting the specific needs and risks associated with their operations. A comprehensive approach is vital to mitigate potential threats and protect user data.

| Platform | Security Measures |

|---|---|

| Platform A | Multi-factor authentication, regular security audits, data encryption, secure payment gateways. |

| Platform B | Advanced fraud detection systems, encryption of sensitive data, secure storage solutions, compliance with industry regulations. |

| Platform C | Blockchain-based transaction records, smart contracts for automated processes, decentralized identity management, and zero-trust architecture. |

Regulatory Landscape and Compliance

Automotive fintech platforms operate within a complex regulatory environment, requiring meticulous compliance with a range of laws and regulations. Navigating these intricacies is crucial for success, ensuring both the safety and trust of users. Compliance requirements vary significantly across jurisdictions, necessitating a tailored approach for each market.The regulatory landscape for automotive fintech platforms is dynamic and evolving, mirroring the rapid advancements in technology and financial services.

This necessitates a proactive and adaptable approach to compliance, ensuring platforms remain aligned with the latest regulatory frameworks.

Regulatory Framework Overview

The regulatory framework governing automotive fintech platforms encompasses a diverse array of legal provisions, touching upon consumer protection, financial services, data security, and anti-money laundering (AML). These regulations are designed to safeguard consumers and maintain the stability of the financial system. A core principle is the alignment of platform operations with the relevant laws and guidelines in each jurisdiction.

Automotive fintech platforms are really changing the game, offering innovative ways to manage car finances. Thinking about how these platforms could adapt to the rise in demand for pandemic-ready car features, like contactless payment systems and enhanced hygiene features, pandemic-ready car features are a key area for future development. Ultimately, this integration of tech and car features could boost the adoption and accessibility of automotive fintech services.

Compliance Requirements by Jurisdiction

Compliance requirements vary significantly across different jurisdictions. For example, the EU has a robust set of regulations like the GDPR, impacting data handling and privacy. The US, with its diverse regulatory landscape, has specific requirements for financial institutions, consumer protection, and cybersecurity. Different regions may have unique regulations concerning the specific financial services offered by the platform, like vehicle financing or insurance.

This necessitates careful analysis of local regulations before operating in a particular market.

Role of Regulatory Bodies

Regulatory bodies play a critical role in shaping the automotive fintech industry. They establish standards, enforce compliance, and foster a level playing field for all participants. Their oversight ensures the safety and stability of the financial system, mitigating potential risks. For example, the FCA (Financial Conduct Authority) in the UK actively monitors and regulates financial innovation, impacting fintech platforms operating within the UK market.

Key Regulations Impacting the Sector

A summary of key regulations impacting automotive fintech platforms includes:

- Consumer Protection Laws: These laws dictate how platforms must treat customers, ensuring fair and transparent practices in areas like pricing, terms and conditions, and dispute resolution. Examples include the Consumer Financial Protection Bureau (CFPB) in the US, and equivalent bodies in other jurisdictions.

- Data Privacy Regulations: Regulations like GDPR in the EU and CCPA in California mandate the secure handling and protection of user data. These regulations specify data collection, use, and storage practices, ensuring user privacy.

- Financial Services Regulations: Regulations concerning financial institutions, such as those related to licensing, capital requirements, and operational controls, might apply to platforms offering financing or investment products. These requirements vary by jurisdiction.

- Anti-Money Laundering (AML) Regulations: AML regulations require platforms to implement procedures to detect and prevent money laundering activities. Failure to comply can lead to severe penalties.

These regulations underscore the importance of compliance in the automotive fintech space, highlighting the need for comprehensive understanding and adaptation to evolving regulatory frameworks.

Competitive Analysis and Differentiation

The automotive fintech market is experiencing rapid growth, attracting numerous players vying for market share. Understanding the competitive landscape and the strategies employed by leading companies is crucial for navigating this dynamic environment. This analysis delves into the key players, their competitive advantages, and the factors driving their success.A significant aspect of the competitive landscape is the varying approaches taken by different platforms.

Some emphasize user experience and ease of use, while others prioritize specific financial services or technological infrastructure. Successful platforms typically demonstrate a combination of these strengths, tailoring their offerings to meet the needs of particular customer segments within the automotive industry.

Key Players and Strategies

Several prominent companies are shaping the automotive fintech landscape. These include established financial institutions entering the space, as well as dedicated fintech startups. The strategies employed by these companies vary, reflecting their individual strengths and market positioning. Some companies focus on leveraging their existing infrastructure to integrate fintech services into their current offerings, while others are building entirely new platforms from the ground up.

Differentiation Factors

Successful automotive fintech platforms often differentiate themselves through innovative features and a strong focus on customer experience. The platforms that stand out frequently offer comprehensive solutions for various automotive needs, integrating seamlessly with the existing workflows and processes within the industry. A platform that offers streamlined financing solutions, combined with an intuitive user interface and secure data management, is likely to gain a strong competitive edge.

Competitive Advantages of Leading Platforms, Automotive fintech platforms

| Platform | Competitive Advantage |

|---|---|

| Platform A | Exceptional user experience, robust security measures, and a wide range of integrated financial products for various automotive transactions. |

| Platform B | Strong focus on streamlining the entire vehicle financing process, from loan application to disbursement. Leverages advanced data analytics for improved risk assessment and personalized customer service. |

| Platform C | Cutting-edge technological infrastructure, offering seamless integration with existing automotive dealership systems and providing real-time transaction tracking. |

| Platform D | Specialization in providing financing solutions specifically tailored to electric vehicle purchases, addressing the unique needs of this growing market segment. |

Integration with Existing Systems

Automotive fintech platforms must seamlessly integrate with existing systems to maximize efficiency and user experience. This integration is crucial for fostering a unified ecosystem that streamlines processes and reduces friction for all stakeholders, from dealerships to consumers. A well-integrated platform can significantly enhance the overall value proposition by providing a holistic view of the automotive transaction lifecycle.

Importance of Integration with Existing Systems

Integration with existing dealership and manufacturer systems is paramount for a successful automotive fintech platform. This allows for real-time data exchange, reducing manual data entry and minimizing errors. Accurate and timely information is vital for financial calculations, risk assessments, and overall operational efficiency. This integration ensures data consistency and reliability, fostering trust and confidence in the platform’s services.

Seamless Integration with Dealerships and Manufacturers

A critical aspect of the integration process is achieving seamless communication with dealership and manufacturer systems. This requires robust APIs (Application Programming Interfaces) to facilitate data exchange. Real-time access to vehicle inventory, pricing, and financing options is essential for providing accurate and up-to-date information to consumers. For example, a platform might integrate with a manufacturer’s system to verify vehicle history and recall information, providing transparency and reducing potential issues.

Integration with Online Marketplaces for Vehicles

Integrating with online marketplaces for vehicles, such as online classifieds or auction platforms, is crucial for reaching a wider customer base. This integration allows the fintech platform to access a broader range of vehicles, facilitating the discovery and comparison of options. Furthermore, it can streamline the transaction process by enabling direct communication and efficient handling of transactions across different platforms.

Detailed Explanation of the Integration Process for a Specific Platform

Consider a hypothetical platform, “AutoFinancePro,” focused on providing digital financing solutions for used vehicles. The integration process would involve several key steps. First, AutoFinancePro would establish secure API connections with participating dealerships. This would enable real-time access to vehicle details, including VIN (Vehicle Identification Number), mileage, and pricing. Second, the platform would integrate with manufacturer databases to verify vehicle history and compliance.

Third, integration with online marketplaces would enable the platform to access listings and facilitate direct communication with sellers and buyers. Finally, a secure payment gateway would be integrated to facilitate seamless transactions. This integration would result in a single platform that allows users to view vehicle information, compare financing options from multiple lenders, and complete the transaction without switching between various systems.

Future Outlook and Predictions: Automotive Fintech Platforms

The automotive fintech landscape is poised for significant growth, driven by evolving consumer preferences and technological advancements. Expect a surge in innovative solutions that streamline financial interactions within the automotive ecosystem. This will lead to a more seamless and personalized experience for consumers, impacting everything from financing to insurance.

Projected Growth and Development

The automotive fintech sector is expected to experience substantial growth in the coming years. Factors such as rising adoption of digital payment methods, increased demand for online car buying and financing, and the integration of AI and machine learning are major drivers. This translates to a predicted expansion in the market share of automotive fintech platforms. The market’s expansion will also depend on successful strategies for overcoming potential obstacles, like regulatory hurdles and security concerns.

For example, platforms focused on personalized financing solutions, such as those tailored to specific demographics or credit profiles, are likely to gain traction.

Impact of Emerging Technologies

Emerging technologies like AI, machine learning, and blockchain are poised to significantly impact the automotive fintech sector. AI-powered systems can analyze vast datasets to assess creditworthiness more accurately and provide tailored financing options. Machine learning algorithms can improve fraud detection, reducing financial risks. Blockchain technology can enhance transparency and security in transactions, building trust and fostering innovation.

These technological advancements will redefine how financial products are developed and delivered in the automotive space. For instance, a platform leveraging AI to instantly evaluate loan applications and provide real-time approval decisions is a prime example of how technology is transforming the sector.

Automotive fintech platforms are rapidly evolving, aiming to streamline financing and transactions in the industry. This directly impacts future vehicle design, as seen in the trends of automotive design 2030. These platforms will play a crucial role in shaping the automotive landscape, offering innovative solutions for both buyers and sellers.

International Expansion and Partnerships

International expansion and strategic partnerships are crucial for automotive fintech platforms aiming for sustained growth. Expanding to new markets allows access to diverse customer bases and potentially higher revenue streams. Collaboration with local partners can provide valuable market insights and facilitate regulatory compliance. For example, a platform that currently operates domestically might partner with a European financial institution to access the European market.

Such partnerships can allow the platform to benefit from the local partner’s expertise and regulatory knowledge.

Future Trends Summary

Automotive fintech platforms are predicted to evolve toward more personalized and integrated solutions. Expect increased use of AI and machine learning to optimize financial processes, improved security measures, and a greater emphasis on user experience. International expansion will become crucial for scaling operations and market penetration. Furthermore, a seamless integration with existing automotive systems will be paramount to ensuring user adoption and minimizing friction.

This integration will create a more efficient and comprehensive ecosystem for all stakeholders, from dealerships to consumers.

Final Summary

In conclusion, automotive fintech platforms are rapidly evolving, offering a promising future for the industry. These platforms are not just improving efficiency and convenience; they are fundamentally changing the way people interact with their vehicles. The future looks bright, with significant potential for innovation and growth, driven by technological advancements and evolving customer expectations.

Common Queries

What are some common security measures used by automotive fintech platforms?

Many platforms utilize multi-factor authentication, encryption, and secure data storage to protect user information and transactions. Compliance with industry regulations and standards is also a key security factor.

How do these platforms integrate with existing automotive systems?

Integration with dealerships, manufacturers, and online marketplaces is crucial. Platforms often utilize APIs and standardized protocols to connect seamlessly with existing systems, enabling a smooth flow of information and transactions.

What are the key regulations impacting automotive fintech platforms?

Regulations vary by jurisdiction and can include consumer protection laws, financial regulations, and data privacy standards. Compliance with these regulations is essential for platform operations.

What are some of the emerging opportunities within the automotive fintech market?

Emerging opportunities include the development of personalized financing solutions, innovative insurance products, and new ways to manage vehicle maintenance and repairs, all designed to enhance the customer experience.